How To Use Gann Square In Tradingview 2023

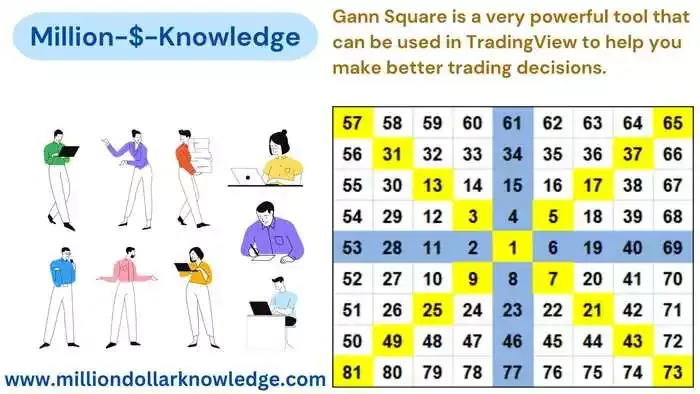

Gann Square is a very powerful tool that can be used in TradingView to help you make better trading decisions. It is a tool that was developed by W.D. Gann, a very successful trader who made a fortune in the stock market. The Gann Square is a tool that can be used to predict support and resistance levels, as well as trend reversals.

Hello friends, welcome to Million-$-Knowledge, a free e-learning portal where you will get answers to almost all your questions. In this article, we will show you how to use the Gann Square in TradingView, keep reading!

|

| How to use gann square in tradingview |

💰 Topic Of Contents:

- Introduction

- What is a Gann Square?

- What are the benefits of using a Gann Square?

- How can you use it in TradingView?

- How Gann Square can be used to predict market movements?

- Final thoughts

What is a Gann Square?

The Gann Square is a tool that is used by traders to predict market movements. It is based on the theory that markets move in cycles and that these cycles can be identified and used to make trading decisions. The Gann Square is a nine-square grid that is used to plot price movements. The outermost squares are used to plot the high and low prices, while the inner squares are used to plot the opening and closing prices.

The Gann Square can be used to trade a variety of markets, including stocks, commodities, and currencies. It can be used to trade both long and short-term timeframes. The Gann Square is a versatile tool that can be used by both day traders and swing traders.

What are the benefits of using a Gann Square?

Some of the benefits of using a Gann Square include:

- The ability to identify key support and resistance levels

- The ability to predict market trends

- The ability to time market entries and exits

- The ability to identify market cycles

While there is no guarantee that using a Gann Square will result in successful trades, it can be a useful tool for those looking to gain an edge in the markets.

Read Also:

- 20 best business ideas start in india

- How to become financially independent?

- How to earn millions by investing in IPO?

- The clear and simple concept of inevestment

How can you use it in TradingView?

Gann Square is a fairly simple indicator to use. It consists of a grid of nine squares, each of which represents a different time period. The center square represents the current price, and the other eight squares represent price levels that are two, four, six, eight, and ten periods behind or ahead of the current price.

To use Gann Square, you first need to identify the trend of the market. If the market is in an uptrend, you would look for buying opportunities, and if the market is in a downtrend, you would look for selling opportunities. Once you have identified the trend, you can use Gann Square to identify potential support and resistance levels.

If the market is in an uptrend and the price is approaching the center square from below, it may be a bullish signal that the price is likely to continue to increase. On the other hand, if the market is in a downtrend and the price is approaching the center square from above, it may be a bearish signal that the price is likely to continue to decrease.

The key to using the Gann Square is to look for confluence with other technical indicators to confirm your analysis. By combining the Gann Square with other indicators such as moving averages, trend lines, and support/resistance levels, you can increase your chances of making accurate trading decisions. You can know more about tradingview by click on the link.

How Gann Square can be used to predict market movements?

This tool can be used to predict future market movements by plotting price movements on a grid. This grid can then be used to identify patterns and trends that may predict future market movements.

The Gann Square is a nine-square grid that is used to plot price movements. The squares are numbered 1-9, and each number corresponds to a price level. For example, if the price of a stock is $10, the 1st square would be $10, the 2nd square would be $20, the 3rd square would be $30, and so on.

Gann Square can be used to predict both short-term and long-term market movements. For short-term predictions, traders look at the recent price action and try to identify patterns. For long-term predictions, traders use Gann Square to plot significant historical price movements and look for future trends.

To use the Gann Square, a trader would plot the most significant price movements of an asset on the grid. They would then draw diagonal lines between the squares, which are known as Gann Lines or Gann Angles. These lines are used to indicate potential levels of support and resistance, which can be used to make trading decisions.

Final thoughts

Gann Square is a useful tool for traders looking to identify potential support and resistance levels based on underlying patterns and cycles in the market. It should be used in conjunction with other technical indicators to confirm the analysis and improve accuracy in trading decisions.

While Gann Square is a popular tool among traders, it's important to remember that no tool is 100% accurate. However, this tool can be a helpful tool for those who are looking to get an edge in the market.

DISCLAIMER: This is an Education Program and is NOT registered under any SEBI rules. All the information we provide is for educational purposes only and you should consult your financial advisor before making any investment decision. Also, WE DO NOT PROVIDE any kind of Stock Advice or Stock Advice or Portfolios. Description & Pressed Comments may contain affiliate links, which means that if you click on one of the product links, we will receive a small commission.

Read More: